2024 Form 990 Schedule An Exchange

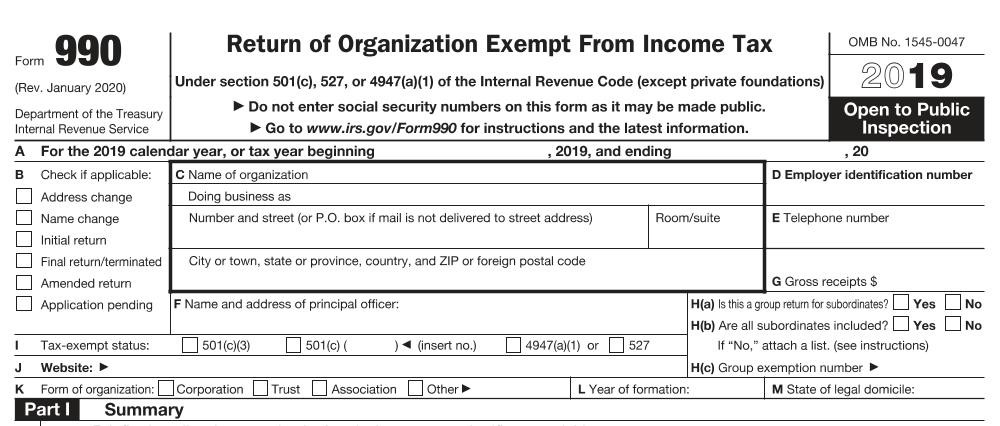

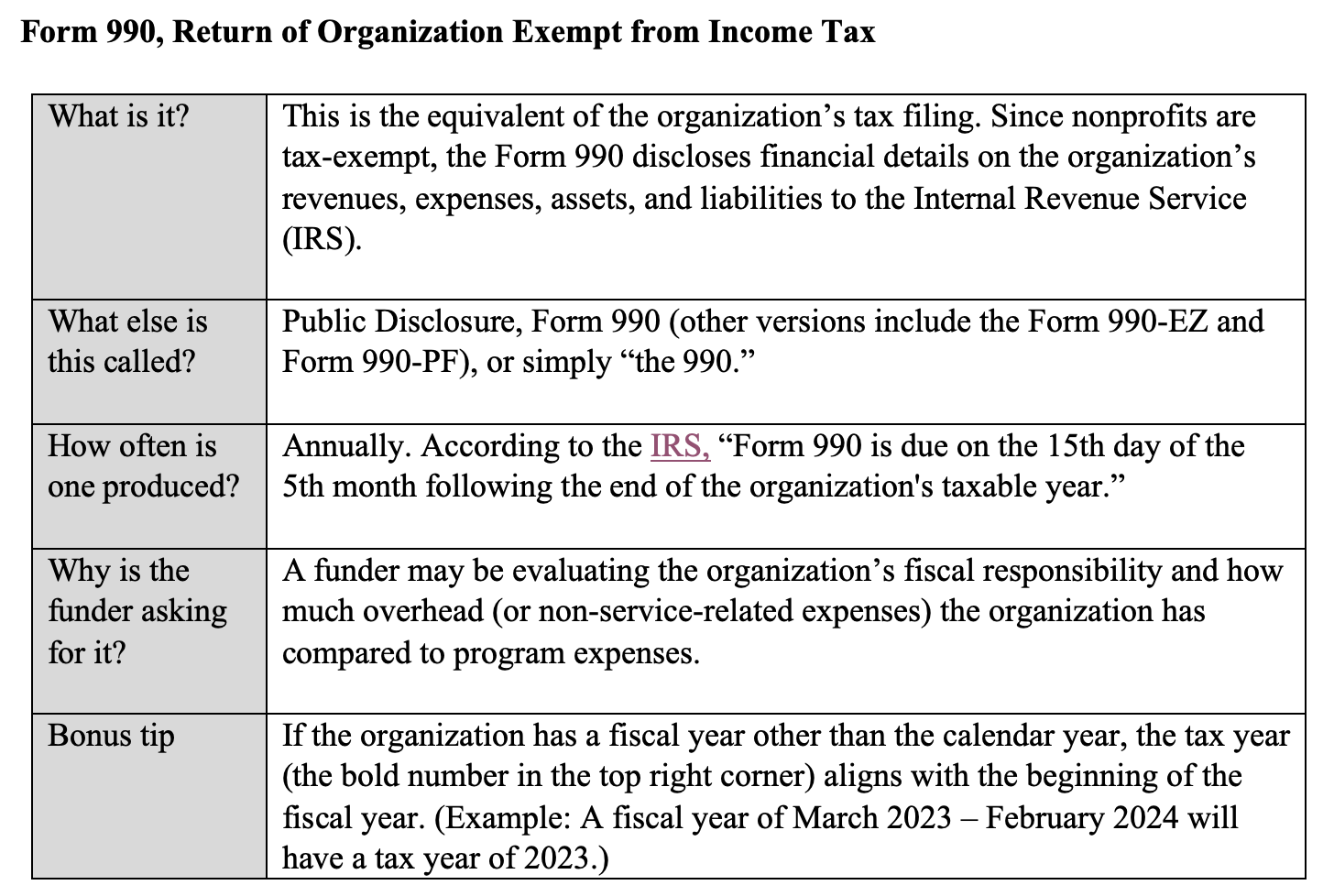

2024 Form 990 Schedule An Exchange – One of the most commonly used schedules that organizations use to provide supplemental information to Form 990 is Schedule O. All pages of Form 990 are available on the IRS website. Special . You’ll be asked to sign into your Forbes account. Form 990 is a required filing that creates significant transparency for exempt organizations. In 1971, it was harder to get your hands on a Form .

2024 Form 990 Schedule An Exchange

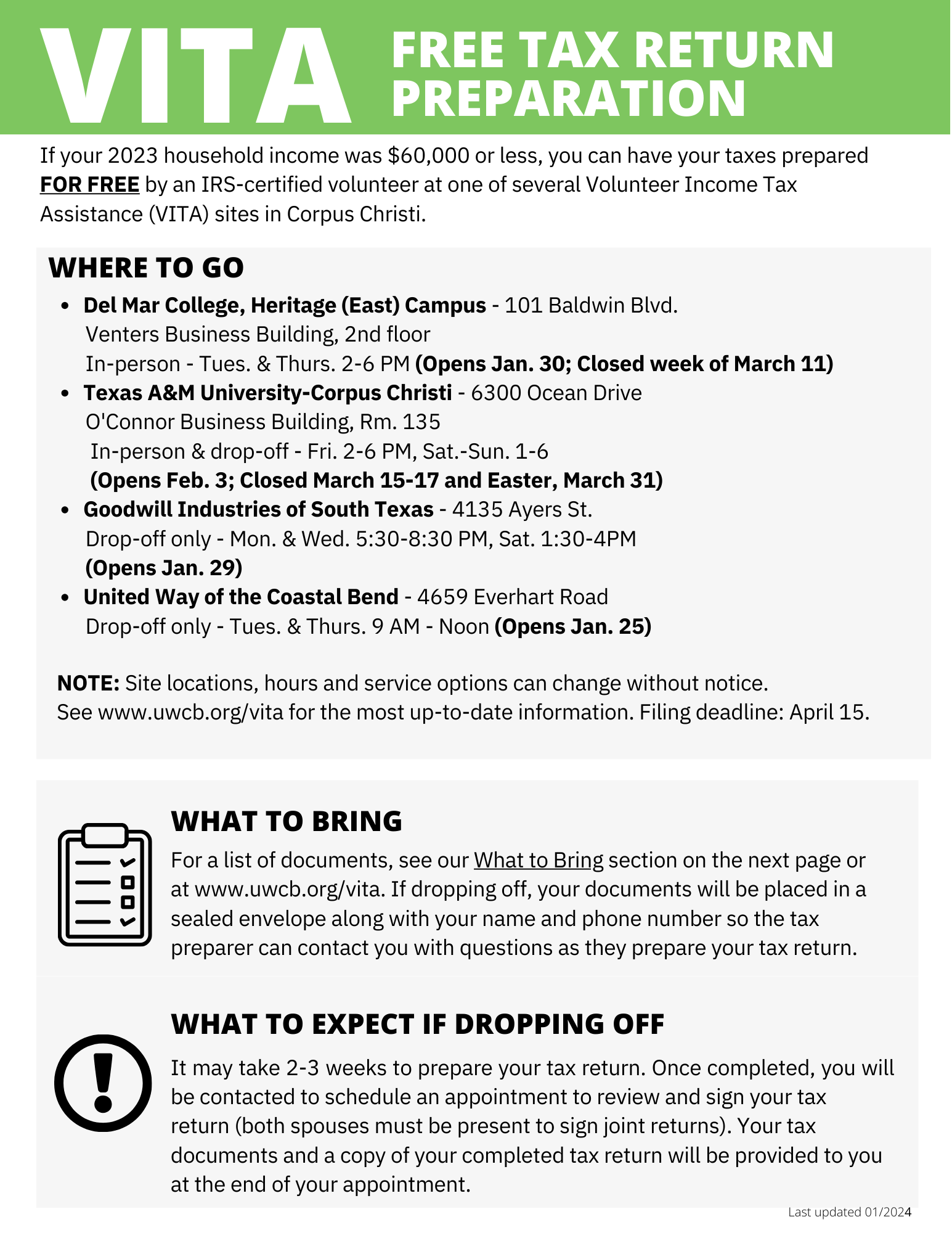

Source : www.501c3.orgVolunteer Income Tax Assistance | United Way of the Coastal Bend

Source : www.uwcb.org2019 IYF Form 990 | International Youth Foundation

Source : iyfglobal.orgMaintaining Your Tax Exempt Status

Source : www.tgccpa.comAbout JCIE/USA JCIE

Source : www.jcie.orgBelinda Yarborough Blessed Bookkeeping Services | LinkedIn

Source : www.linkedin.comAssel Grant Services | Did you know: the difference between common

Source : asselgrantservices.comSummary of IRS Guidance on Elective Pay and Transferability of

Source : www.zeta2030.orgOlbrich Botanical Gardens | Olbrich Botanical Society

Source : www.olbrich.orgForm 990: Return of Organization Exempt from Income Tax Overview

Source : www.investopedia.com2024 Form 990 Schedule An Exchange Understanding the IRS Form 990 Foundation Group®: Only available to the smallest of non-profit organizations, Form 990-N is the simplest form of tax reporting for tax-exempt groups. Organizations with usual receipts of $50,000 or less file Form . And depending on the type of organization you are forming, you will also need to fill out one of the attached schedules (e.g., Schedule A “Instructions for Form 990 Return of Organization .

]]>

:max_bytes(150000):strip_icc()/ScreenShot2021-02-12at5.09.36PM-b75ba9a9a4d64190a7e9d8297218886a.png)